INVESTMENT

The Simple Path to Wealth

My review of The Simple Path to Wealth by J L Collins. What started out as a set of letters to his daughter ended up as a personal finance classic.

The financial services industry sometimes seems to exist to make things complicated. Jim Collins provides a valuable antidote. His simple formula:

Spend less than you earn — invest the surplus — avoid debt

Might seem trite but gets to the heart of the aspects of your financial life you can predict and control.

Collins advocates financial independence rather than early retirement. The ability to have choices: to say no to what you don’t want and yes to what you do. This is not a book about denying yourself today to reach utopia tomorrow. It’s about understanding what’s truly rewarding and creating a financial plan so you can fill your life with as much of that as possible.

Avoid debt

It’s fair to say that Collins is not a fan of debt. Even what he refers to as ‘good debt’ should be treated with caution. Mortgage debt would typically fall into this category. Collins’ advice is this:

If your goal is financial independence, it is also to hold as little debt as possible. This means you’ll seek the least house to meet your needs rather than the most house you can technically afford.

The first thing that many successful professionals do after the inflexion point in their career is to mortgage up for their ‘forever house’. That’s fine, but the psychology of habituation means that the bigger house quickly blends into the background of your life and ceases to provide the extra happiness you expect.

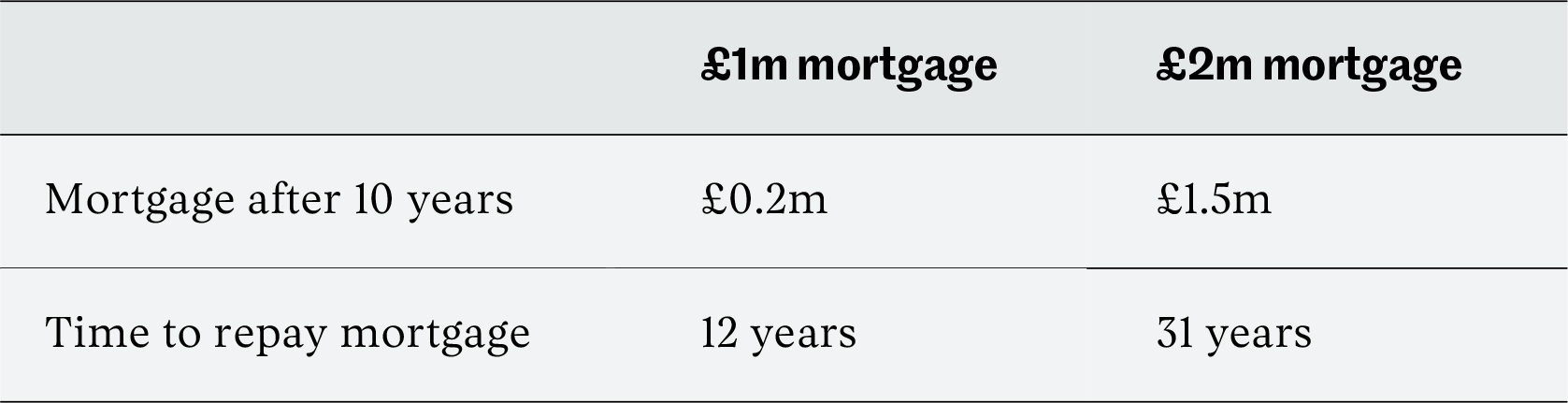

Yet the financial costs are significant — and these costs translate into fewer options and the obligation of a longer working life. The table below shows the impact of repaying £100,000 per year on a repayment mortgage at a 3% interest rate.

With a £1m mortgage, you’re mortgage-free after little more than a decade. With a £2m mortgage only a quarter of the loan has been paid off after 12 years and the total time to repayment is over 30 years. Who has the most choices about what to do with their life?

Large mortgages are one of the four horsemen of the financial apocalypse, along with children (especially privately educated ones), fast cars and divorce.

Spend less than you earn

Collins recommends a 50% savings rate. Why 50%? Because this is broadly the savings rate you need to achieve financial independence over a 15 year time horizon, leaving you with freedom and choices at a relatively young age. This type of savings rate also makes a visible dent in that goal over a decade. I’ve found this type of number also holds true for the career paths of many successful professionals.

According to Collins, the perfect time to implement good savings habits is when you come out of college. You’re used to living on a shoestring so you can increase your standard of living at the same time as increasing your savings rate.

But another great time to make the change is when you’re a successful professional going through the inflection point in your career in your early thirties. Over this period, income frequently goes up 3-4x over a matter of just a few years as you enter the ranks of partner in a professional services firm or VP in a corporation. What if, over this period, you allowed your expenditure to increase 50% but you saved the rest? It would still be a massive improvement to your material standard of living and even if you’d been saving nothing before, you’d end up with a savings rate of over 50%.

You might say: “I want to enjoy more of the money today, and anyway I’ll always want to work so I can sort it out in future.” Maybe, but at the same time you don’t know how you’ll feel about your job in 15 years’ time or how your job will feel about you. Given that ramping up your expenditure is unlikely to lead to a commensurate impact in terms of wellbeing, why not give yourself some choices?

Invest the surplus

Most of Collins’ book is devoted to convincing people that a really simple investment strategy is enough, involving just two Vanguard funds — an equity fund and a bond fund. We really don’t need to make it more complicated. In this he’s almost certainly right, but there are a couple of adjustments it’s worth making if you’re reading the book today. Probably a global stock market fund is more suitable for most investors than the US market fund he recommends. And the prospective returns that we can expect to get in future, given current market levels and interest rates, are likely less than the rate Collins uses based on history. Finally, Vanguard isn’t the only good provider out there!

But the principles remain sound. Keep investing 50% of what you earn every year, keep a significant exposure to stocks, allow the returns to compound over time, use available tax-free accounts, keep things simple and costs low. Do these things and a decade on you will already see how financial independence beckons. You really don’t need to do anything fancier or more complicated than that.

A handbook for DIY investors

Collins’ book is slightly US-centric, particularly when it comes to discussion of tax wrappers and the like. But The Simple Path to Wealth remains a great handbook for aspiring DIY investors. It lays out the case for taking command of your own money rather than outsourcing decisions to someone who will care less about it than you and charge you a handsome sum for the privilege. And it provides a simple guide to how to do this in practice, so as to achieve your life goals.

I’ll finish this review as Collins finishes his book:

The path is before you. You need only take the first step and begin. Enjoy your journey!