INVESTMENT

Property vs the stock market

For most people, the stock market is a better bet than buy-to-let.

Where should I invest my money for growth?

This is a question faced by all successful professionals. You’ve hopefully controlled your spending to create a surplus of income over expenditure. The question then is where to invest it to beat off the ravages of inflation and deliver long term, real growth.

The two most common investments I see are stock market investments, typically through funds, and buy-to-let residential property investment. A lot of people are instinctively drawn to the latter. It somehow feels ‘tangible’ and ‘safe’. Perhaps through familiarity. Whereas the stock market feels ‘intangible’ and ‘risky’. Some people also find a sense of self-importance and status through owning a property portfolio. The popularity of programmes like Homes Under The Hammer shows us to be a nation of wannabe property moguls.

Not so easy

But property investing isn’t as easy as sometimes assumed. Costs are high and often not accounted for properly in estimates of property returns. Property is illiquid, meaning that it can be tough to convert it to ready cash. It tends to lack diversification unless you have a portfolio of properties in many different locations. Most of us are already substantially exposed to property through our primary residence. As Lars Kroijer points out in Investing Demystified familiarity with property doesn’t mean we have an ‘edge’ when it comes to identifying the best deals and acquiring properties at the right price. Property is also a hassle when it goes wrong, dealing with problematic tenants, neighbours or structural problems.

Property prices do sometimes fall — the 15% fall in 2008 for example. And there are good arguments that the recorded price falls are an underestimate. For when prices fall, the market often just freezes. Transactions dry up as people sit it out. COVID has shown us that unexpected events can throw a spanner in the works and dislocate regional housing market trends. Life for landlords is getting tougher, both in terms of regulations for dealing with tenants and tax rules for property income.

The power and risks of leverage

That’s not to say it can’t work out for people. The big benefit of property investment is that it enables a leveraged bet on the housing market. There aren’t many asset classes where normal people can borrow to invest. This leverage can supercharge returns — provided house prices keep going up. There are good reasons to think that rising house prices are a core (if unstated) objective of government policy. And the combination of population growth and continued paralysis in planning laws arguably puts a floor under what could realistically happen to prices. Given what’s happened to house prices over the last few decades, it’s been pretty hard not to make money in buy-to-let.

But it’s not a sure thing. And those going down this route need to recognise the nature of the leveraged bet they’re taking. Borrowing to invest can supercharge losses as well as gains. Leveraged property investment also concentrates risk. The recession when you’re ushered into redundancy may be the same recession that causes your leveraged property portfolio to sink into negative equity.

What are the returns on property?

One of the problems with assessing property investment is figuring out exactly what the average returns are over time. There are three main reasons for this:

- Property ownership involves lots of indirect costs which are difficult to capture reliably (these include property taxes, lawyers’ fees, insurance, maintenance, voids).

- Matched data on rents and costs for the same property are very difficult to come by. Average rents can be distorted by higher quality properties coming onto the rental market.

- Price series for property are an incomplete picture. Sales activity may not be representative of the entire housing stock (for example, houses may be improved prior to sale) and it is difficult to match capital gains to particular rental data.

As a result of these problems, most estimates of total returns on housing splice together a series of average estimates: for rental yields, price growth and costs of ownership. These are inherently unreliable and subject to bias.

Using this type of approach, The Rate of Return on Everything by Jordà, Knoll, Kuvshinov, Schularick and Taylor, points to real, pre-tax, total returns on UK property over the long term of around 4.7% (geometric average). This compares with long term real returns on a global equity portfolio of 5.3% per annum, according to the Credit Suisse Yearbook 2021. So global equities have a narrow advantage over UK residential property — but it’s an advantage that can easily be overcome if the property is leveraged by purchasing it with a mortgage.

But while the estimate for equities is based on detailed stock market data on real prices and dividends there’s good reason to believe the housing market estimates may be overestimated. In a recent paper, Chambers, Spaenjers and Steiner, studied a detailed database of the property portfolio of four, large Oxbridge colleges over nearly the first 80 or so years of the twentieth century. The database has detailed records by property. This means they are able precisely to match rents, costs and voids at the property level to generate a net rental yield with a very high level of accuracy. Property price data remains patchy, because many of these properties were held for the long term. But the authors have enough direct observations to be able to fill in the blanks and create a good estimate for property prices as well.

Based on this detailed analysis, Chambers and colleagues find systematic biases in the previous estimates of property yields. With their more precise methodology, the calculated annual compound real return on UK residential property slumps to 2.3% a year, a full 3% points below a global equity portfolio. Their analysis finishes in 1983. Undoubtedly the subsequent collapse in interest rates and house price boom would have boosted returns over the last few decades. But their carefully constructed dataset over 80+ years is arguably a better guide to what is to come.

It’s also a result that makes sense. One of the conundrums of previous work on long term property returns has been the apparent free lunch of property investment: stock-market-like returns at much lower volatility. The long term standard deviation of UK residential property returns has been around 9%, half the standard deviation of 20% seen in stock market returns. Yet average returns were believed to be comparable. This anomaly is explained if, in fact, property returns are lower than previously thought.

The benefits and risks of leverage

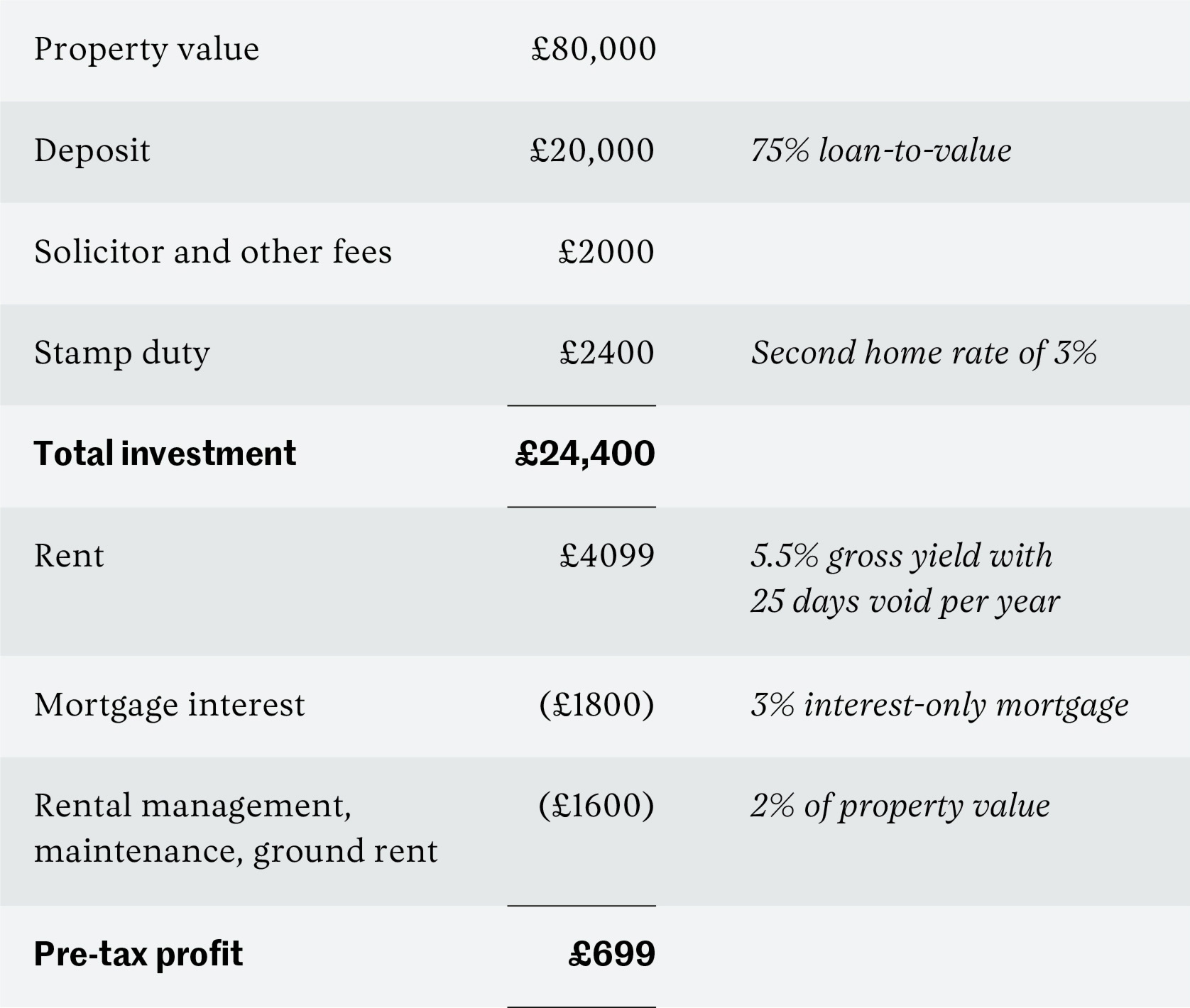

Most buy-to-let property owners boost returns through mortgaging a property. Let’s see what the economics of this looks like at an individual property level, using a range of typical assumptions.

Let’s assume that we buy an £80,000 property with a 75% loan-to-value interest-only mortgage at an average interest rate of 3% (including any mortgage fees). Let’s suppose we can rent out the property for £4400 per year (a 5.5% gross rental yield) but we face voids of 25 days a year on average, when the property is unlet.

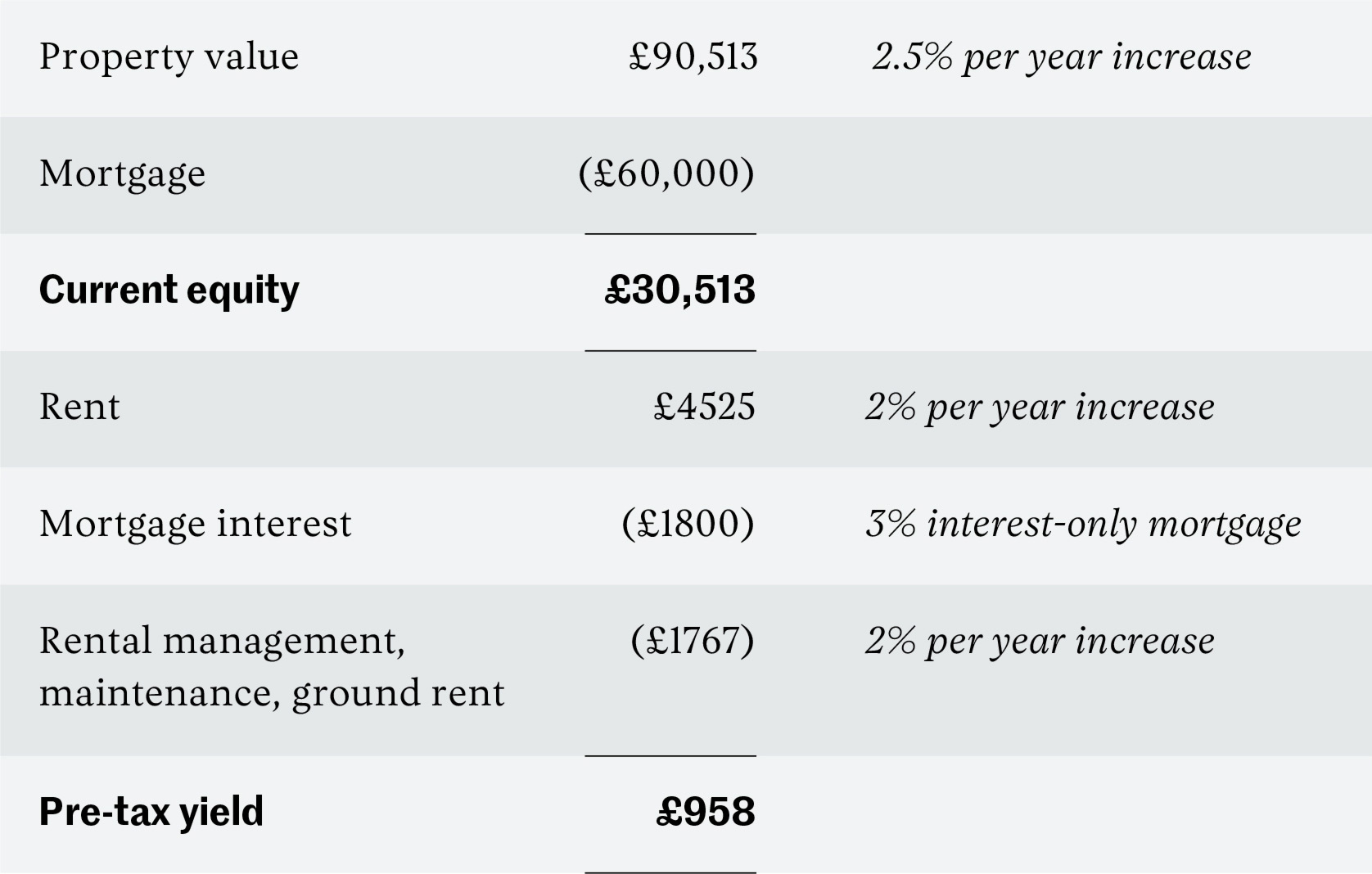

The investment makes a modest pre-tax running yield of 2.9%. But the benefits come over time as rents and property prices grow and inflation eats away at the real value of the mortgage. Let’s roll forward five years, assuming inflation of 2% a year and property price increases 0.5% ahead of inflation, and rental and cost increases in line with inflation, which are quite typical of recent medium term trends.

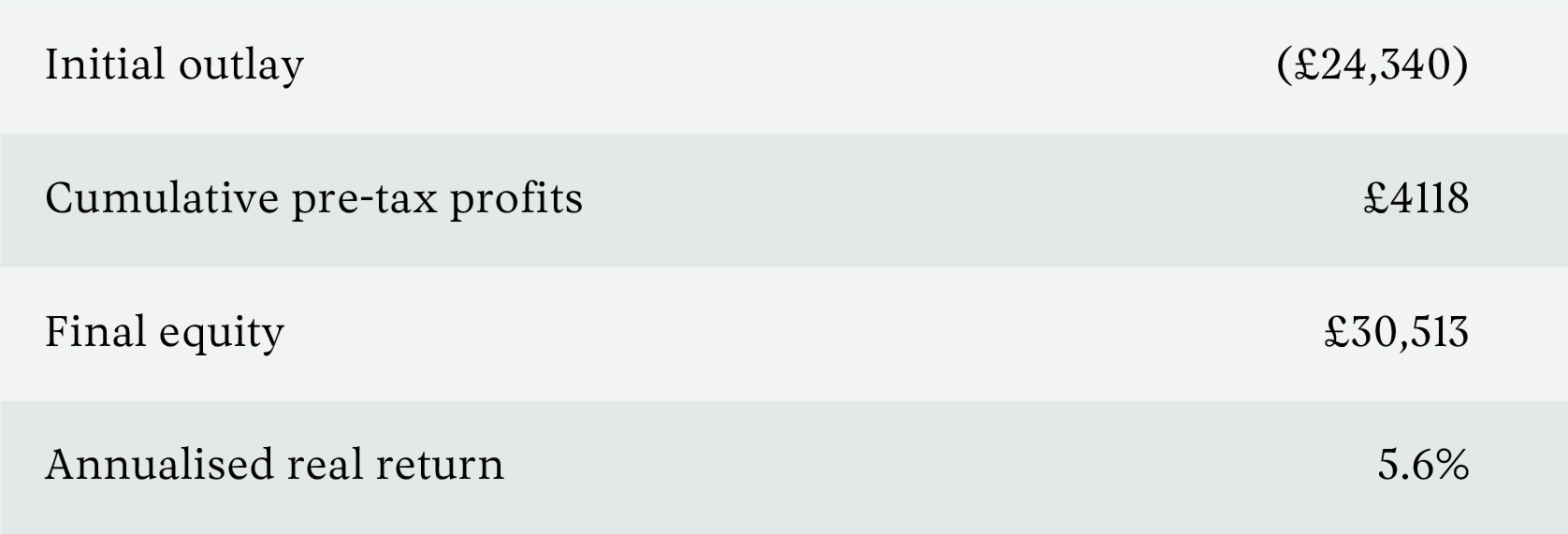

Total pre-tax return over five years is made up as follows:

Note that for the same property bought as an investment without a mortgage, the real return is 2.4% pa, in line with the long run data from Chambers and colleagues. Adding leverage brings the return up to be broadly comparable with a global equity portfolio.

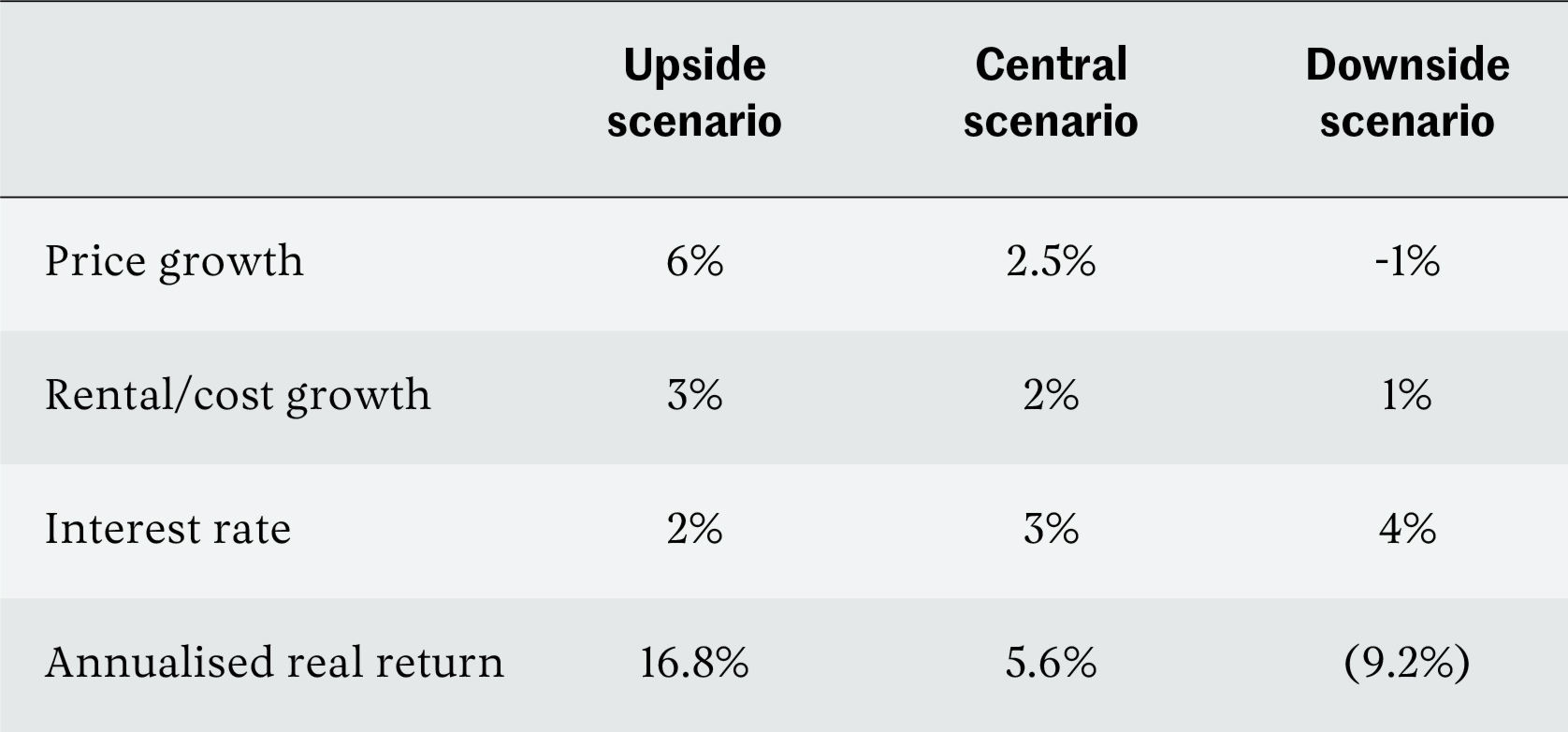

But what about upside and downside scenarios? If we remodel based on high and low five year outcomes for house prices and rental growth, and allowing for a +/- 1% point change in interest rates, we see the dramatic impact that leverage has on the range of returns.

The leverage dramatically magnifies the investment volatility, leading to a range of cumulative five year outcomes (c. +100% on the upside, c. -40% on the downside) that are very comparable to equity market bull and bear scenarios.

By measuring over just five years I’ve arguably been unkind to property — the longer the timeframe, the longer the period over which to spread the fixed costs of stamp duty and legal fees. But on the other hand, a 5.5% gross rental yield is pretty punchy in today’s market. And my figures are consistent with the long term, unmortgaged real return on property observed by Chambers and co-authors.

Implications for successful professionals

So once property is leveraged so that its returns can match that of the stock market, we find the range of outcomes is similar on the upside and the downside. This shouldn’t be a surprise. It would be most unexpected if there was a massive free lunch of higher risk adjusted returns sitting in the residential property market. So what can we conclude for successful professionals considering property investment as an alternative to the stock market? The data suggests that the stock market and leveraged residential property have similar expected returns and risk. But buy-to-let comes with many practical disadvantages:

- Property investment is much more costly in terms of time and hassle, whereas stock market investment can be done with the click of a mouse.

- Mortgaged property also has a significant tail risk — in the event of a property crash, the equity value in the portfolio can be driven to zero, whereas a diversified equity portfolio will never be worth nothing.

- It’s difficult to achieve diversification with property. Unless you build a portfolio of 15 or 20 properties, you’ll be overexposed to the fortunes of one of them. But more properties means more hassle.

- You can always sell a fund — but evicting a troublesome tenant can be a real headache and sometimes a property just can’t be sold (or let).

- Returns on buy-to-let property are taxed less favourably than stock market investments, particularly for higher rate taxpayers.

On the positive side, buy-to-let property can provide some diversification from the stock market. But you already have property exposure if you own your own home. And there may be better ways to get further exposure than by doing it yourself. For example, residential property REITs provide a way of getting exposure to this sector through investment trusts, which do the diversification for you and avoid the liquidity problems of direct property investment.

Best to steer clear

Mortgaged buy-to-let is a valid way to get stock-market-like returns and risk. But only if you’re prepared to treat it like a business: invest at scale to spread costs and get suitable diversification across multiple properties. It’s also a sector where local or specialist knowledge could realistically give you an investment edge if you immerse yourself deeply in the market.

But if you dabble in buy-to-let, you’re likely to get equal or lower returns than the stock market with higher risk. And a bunch of hassle into the bargain.

For most successful professionals, with a full time job elsewhere, it’s not worth it.

Important

Nothing in this article should be taken to represent financial advice. It is generic commentary based on typical circumstances and not tailored to your own situation. If you’re not sure what to do, you should take financial advice.