INVESTMENT

Financial coach vs financial advisor

Financial coaches provide a different, but complementary, service to independent financial advisors. It’s important to understand the differences to decide which best suits your needs.

I’m a financial coach not a regulated independent financial advisor (IFA). So what’s the difference?

As a financial coach I help you make more informed decisions about your life and financial plans. I do this by building your capability through the provision of coaching, education and generic information. These are not regulated services, but as a Fellow of the Institute of Actuaries I’m bound by the Actuaries’ Code. You remain responsible for all the decisions you make and for implementing them. I will not make specific recommendations for you to follow particular strategies or to buy or sell particular products or investments.

An IFA will make recommendations on the best course of action for you, and on the specific investment products and insurance that you should take out. They can then implement these decisions on your behalf, including handling platform administration and product paperwork. These services are all regulated by the Financial Conduct Authority.

A financial coach will spend time helping you to understand your life goals and how to align your finances with them and will also focus on the psychological and behavioural factors relating to your relationship with money. An IFA will tend to focus more on the technical aspects of financial planning, such as cashflow forecasting and the recommendation and implementation of investments and insurance. A good IFA can also be a good financial coach, but it’s rare, and the heavily regulated economic model for IFAs militates against them creating a coaching-led relationship. This is because the IFA will generally earn higher fees if they manage the client’s finances on their behalf.

So I will spend time building your capability to take your own decisions and manage your own finances. An IFA will focus on making recommendations and managing your finances for you.

Historical context

Following changes to the law in 2013 in the UK, IFAs were banned from paying themselves through commission on products sold to consumers. The true costs of commission were frequently hidden within complex products. As a result few consumers understood the very large amounts, running into many thousands or tens of thousands of pounds, that they were paying their financial adviser over the life of the product. Regulators were also concerned that financial advisers were incentivised to recommend the products that were most remunerative to them rather than the ones that were best for the client.

So the Financial Conduct Authority banned IFAs from being remunerated by commission and also raised the qualification standards and regulatory requirements for new IFAs. This has undoubtedly led to increased quality in the industry, but with three remaining problems:

- The regulatory burden on IFAs is high, which must be paid for by the consumer, even if they have advice needs that don’t rely on the IFA’s regulated activities.

- Consumers are not prepared to pay upfront fees at the level that keeps IFA’s income at the level they were used to under a commission-based product. Therefore, the majority of the industry operates on an ‘assets under management model’. Under this model, IFAs try to manage your portfolio on your behalf, and take a percentage of it each year, for example 1% per annum, every year into the future.

- An IFA’s training focuses very much on investment and protection products rather than on clients’ life goals, behavioural biases and emotional needs in relation to money.

The costs for consumers of the assets under management model are significant. For example, a portfolio of £500,000 that doubles to £1m over 10 years after fund costs, would increase to just over £900,000 when invested by an IFA taking a 1% fee – a cost of nearly £100,000 over 10 years. Of course, the IFA might help the client select better performing investments, although the evidence for their ability to do this is scant.

In light of the increasingly visible costs of financial advice, growing numbers of successful professionals, particularly earlier in their life, are looking to manage their own finances using one of the many low-cost platforms now available. However, they don’t know what they don’t know, and are also subject to behavioural biases and inconsistency in following their financial strategy. This can lead to suboptimal outcomes.

Financial coaching fills the advice gap by providing expert coaching and education to individuals in a highly cost-effective manner. The independent perspective and accountability provided by a coach can help the client make better decisions for themselves. I focus on building your skills and capabilities to enable you to successfully manage your own finances. By contrast, the business model of IFAs generally leads to them seeking to take on the management of your finances from you, at often significant cost.

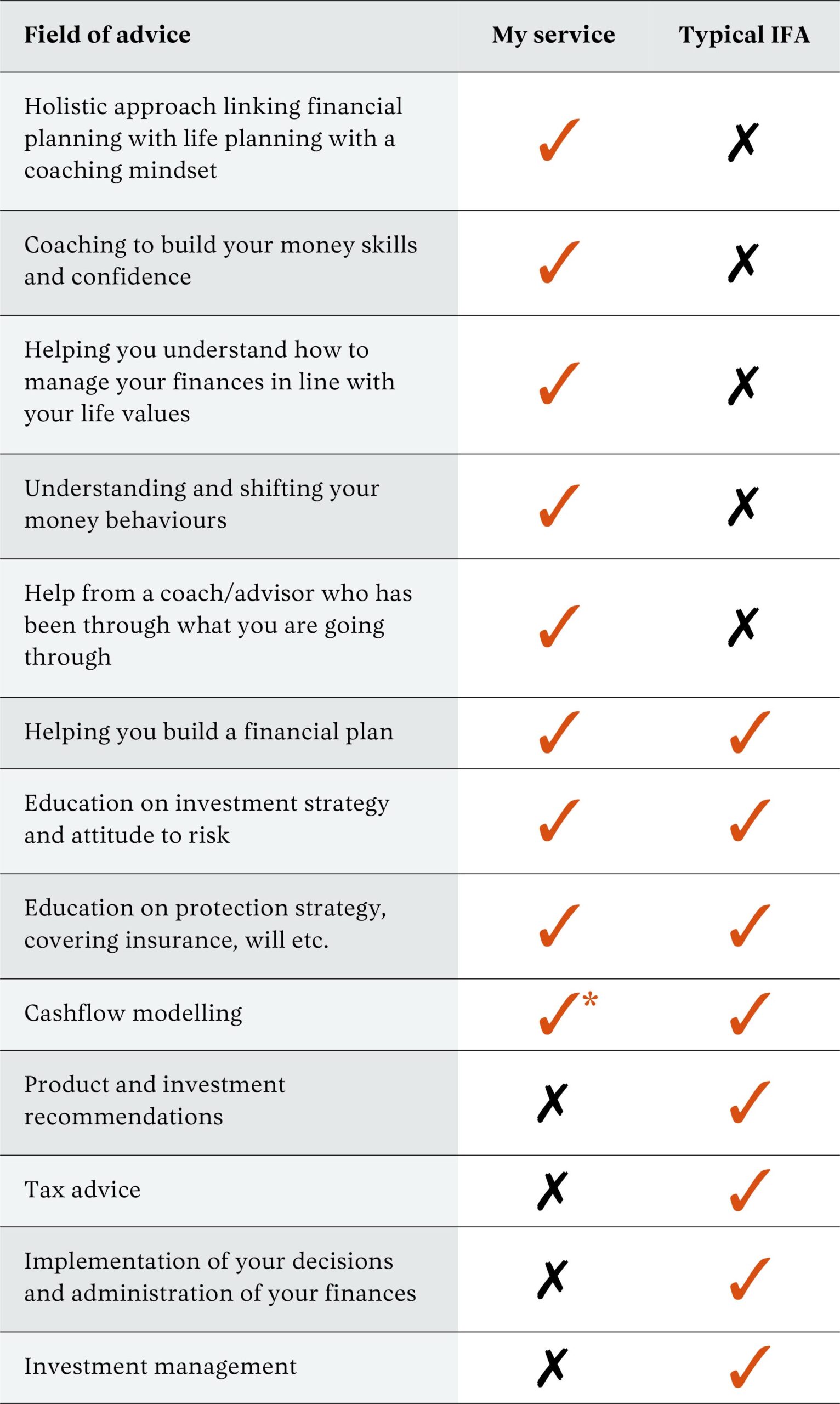

Comparison of services

Different coaches and IFAs will provide a different range of services and prices. Here I compare my service with a typical range of services provided by an IFA.

*I can help you with simple cashflow modelling to support your plan, but for highly detailed cashflow modelling I would recommend use of a financial planner.

Fee models and fees

A typical IFA will charge a percentage of assets under management (typically around 1% per year) for the duration of the relationship. This means £10–20,000 per year for a portfolio of £1–2m based on a combination of fixed assets and a percentage of assets.

My fee model is time-based, fixed fee, with no long term commitment required, although I can act as your ongoing accountability partner and provide an annual financial health check. This provides a highly tailored and cost-effective service at a fraction of the typical cost of an IFA.

When to use a financial coach and when to use an IFA

Most people I work with are also likely to work with an IFA at some point in their lives, most usually as they get to within five years of retirement. However, by working with me you can avoid excessive IFA costs until you really need to pay them. Moreover, by working with me you will be much better equipped — both to select the right IFA and to ensure that you pay only for what you need.

Use a financial coach when:

- You want coaching help to decide on your life plan and to help you build a financial plan to support this.

- You want to manage your own finances and make your own decisions but want to build your confidence or skills, or to have a sounding board.

- You want to build knowledge about investment strategy, financial protection or other financial matters.

- You want help understanding and managing your money behaviours or spending habits.

- You want someone entirely independent with no vested interest in how you invest your money — someone fully in your corner.

- You want help developing a simple cashflow forecast to support your financial plan and check you’re on track.

- You aren’t sure whether you need financial advice and want to speak to someone independent to help you decide.

- You want a flexible and cost-effective level of support with no long-term obligation, which you can ramp up and down as and when you wish.

Use a financial advisor when:

- You want someone to take the burden of decision-making from you.

- You want a specific recommendation on a particular product to meet your requirements; for example, a specific investment fund or insurance policy.

- You are facing a highly technical or product specific decision where you want the assurance of a regulated recommendation, e.g. transferring out of your pension fund, buying an annuity or commencing pension drawdown.

- You want detailed cashflow projections taking into account the details of tax and different investment and withdrawal strategies.

- You want someone to manage your finances on your behalf and handle all the administration rather than taking control of them yourself.

- You have particularly complex financial affairs.

- You want someone to liaise on your behalf between multiple advisers (tax accountant, lawyer etc).

- You are prepared to pay significant annual fees because you see the value in not having to manage your own finances.

Helping you decide

Financial coaches and financial advisers both provide important and valuable services. Which is best for you depends on your circumstances. My commitment to you is to be entirely balanced and transparent in laying out the factors behind the decision, enabling you to select the services you need in an informed manner.