SPENDING

How much is enough?

Many successful professionals have lost touch with how much is enough. As a result they may be putting their lives on hold unnecessarily.

Let’s suppose you’re 35 years old and a senior lawyer in a large company earning £350,000. Your spouse doesn’t work, so your net of tax household income is a little over £200,000.

Even if you only work for 10 years, your next decade’s earnings will put you in the same position as:

- someone your age;

- in a household in the top 25% of the UK earnings distribution;

- who plans to work until 60;

- and who has just had a £1m lottery win.

Do you feel as lucky as you are?

The perils of lifestyle ratchet

When I speak to clients about ‘how much is enough?’ it’s often closely related to what they’re spending now. The trouble is, that’s often quite a lot. Mid-career, these fortunate people can see their income treble or more in a relatively short space of time. Lifestyle ratchet can result in expenses rising as fast (or worse). Before long, people can’t imagine living on less than £200,000 a year.

But this is a problem. Especially if you want the option to take a different path in your fifties, rather than waiting for your firm to spit you out, exhausted, at the retirement age of 60 or 65. Sustaining an income of £200,000 over 40 years of retirement will require a truly gargantuan fund.

So here’s a reality check.

What do other people survive on?

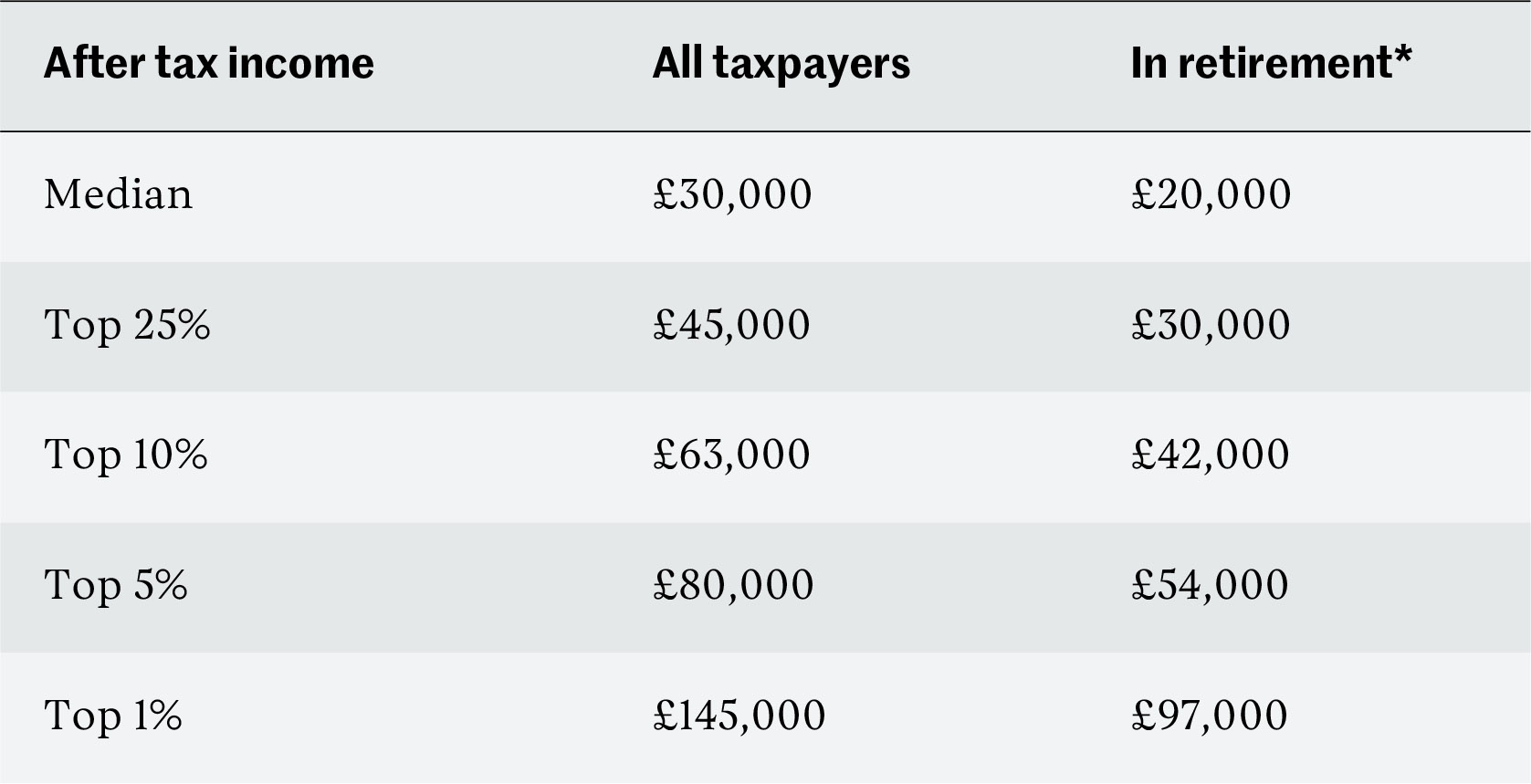

The table shows after tax income for a two-person household, taken from the Office for National Statistics (ONS). Further data from the ONS shows that people in retirement have income around one-third less than the average, so I’ve used this rough rule of thumb to show retirement incomes.

*My estimate

Those habituated to high levels of income might be surprised to see that between 90% and 95% of retirees (and 80% of all people) get by on household income of less than £50,000 a year.

What do the actuaries say you need?

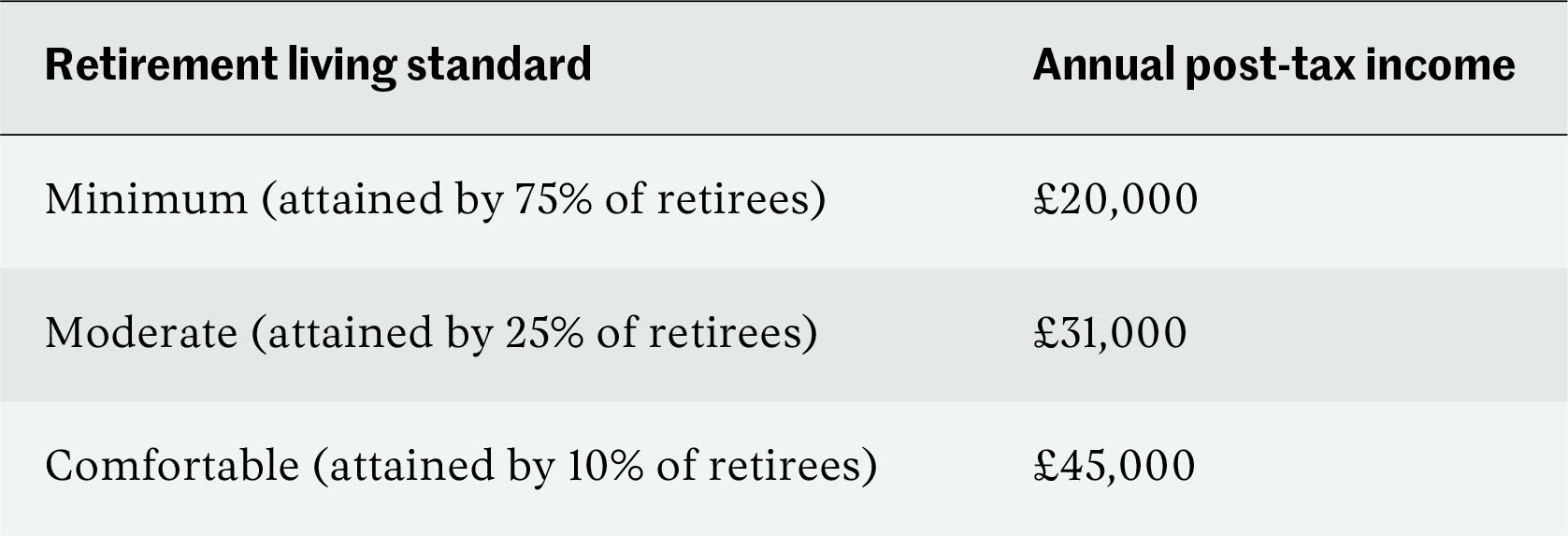

The Pensions & Lifetime Savings Association teamed up with the Institute & Faculty of Actuaries to produce a set of guidelines for what kind of retirement income people should be planning for.

These Retirement Living Standards identify three levels of retirement: minimum, moderate and comfortable. They estimate that around 1 in 10 people will achieve the income level equating to a comfortable retirement. These are pre-tax incomes, but at this level, assuming the income is spread across a couple, the overall tax rate is likely to be less than 10%. I’ve taken the levels for London and the South-East, which are 5% to 10% higher than for the UK overall, converted them to an estimated post-tax value and rounded the figures.

Notably, all these figures are less than £50,000 a year.

What do you need to be happy?

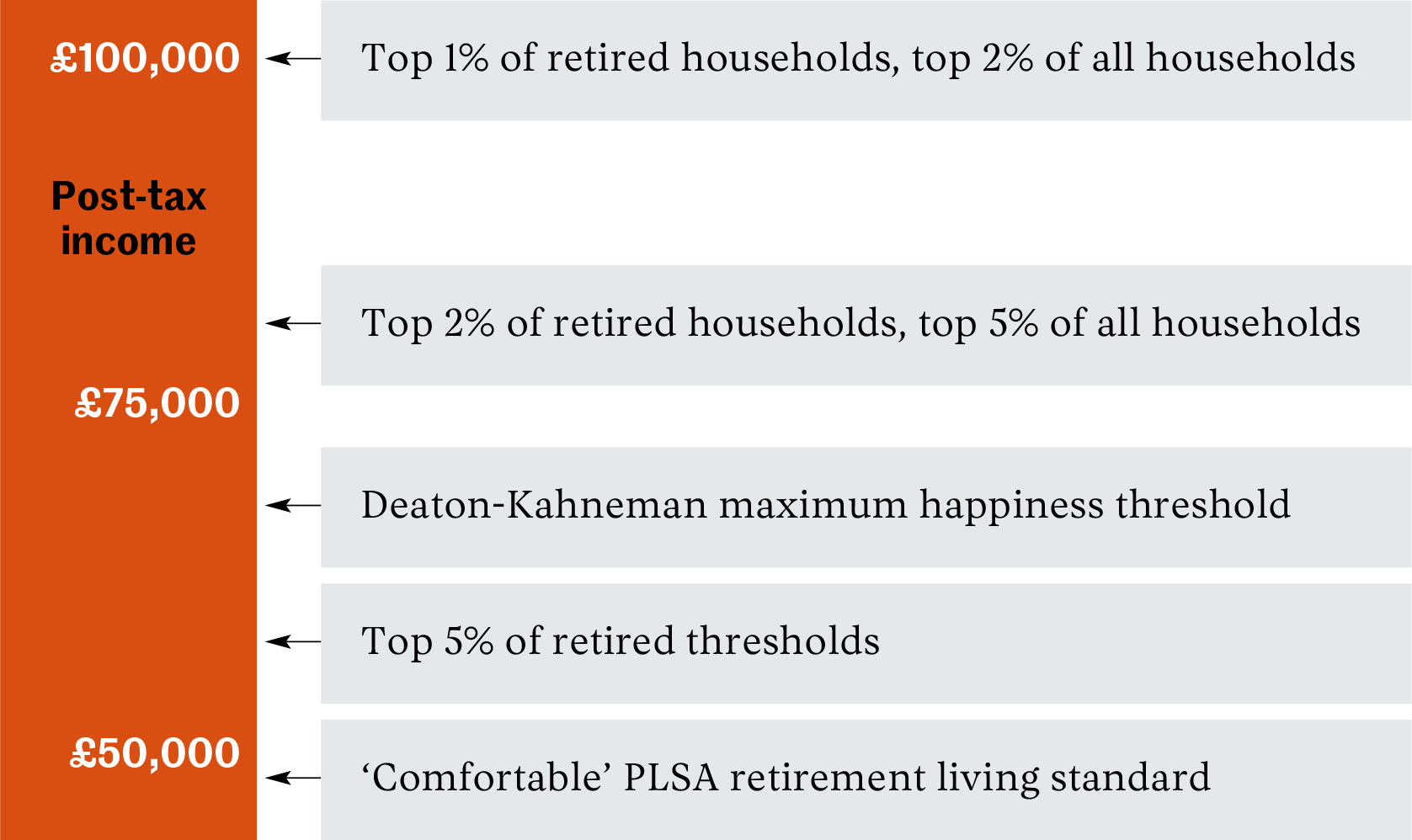

In one of the most famous pieces of research on money and happiness, Angus Deaton and Daniel Kahneman correlated data on income and happiness in the US. They measured happiness in two ways: experienced wellbeing, which reflects day-to-day feelings of happiness, joy, laughter, anger, sorrow, anxiety; and life satisfaction, which reflects how people rate their satisfaction with life overall.

While life satisfaction continued to increase with income over the range of the data sample, experienced wellbeing was maximised at household income of $75,000 a year. This is the level at which the negative aspects of not having enough money are fully mitigated and there’s enough left over to enjoy plenty of pleasurable experiences on a daily basis. It’s worth noting that more recent research, based on a different method for assessing experienced wellbeing, finds that that there is no such cap and that experienced wellbeing continues to increase with income.

But let’s go with the original research for now. It was published in 2010. So updating it for a decade of inflation, taking off some tax based on the typical tax rate for a couple in the US, and converting to Sterling gets us to the following rough figure: a household needs post-tax income of £65,000 a year for maximum happiness.

The life cost of consumption

Looking at a range of data points it’s pretty clear that a household income of £50,000 to £100,000 is plenty for living an extraordinarily comfortable life in both absolute and relative terms. Successful professionals earning hundreds of thousands of pounds a year may have forgotten this.

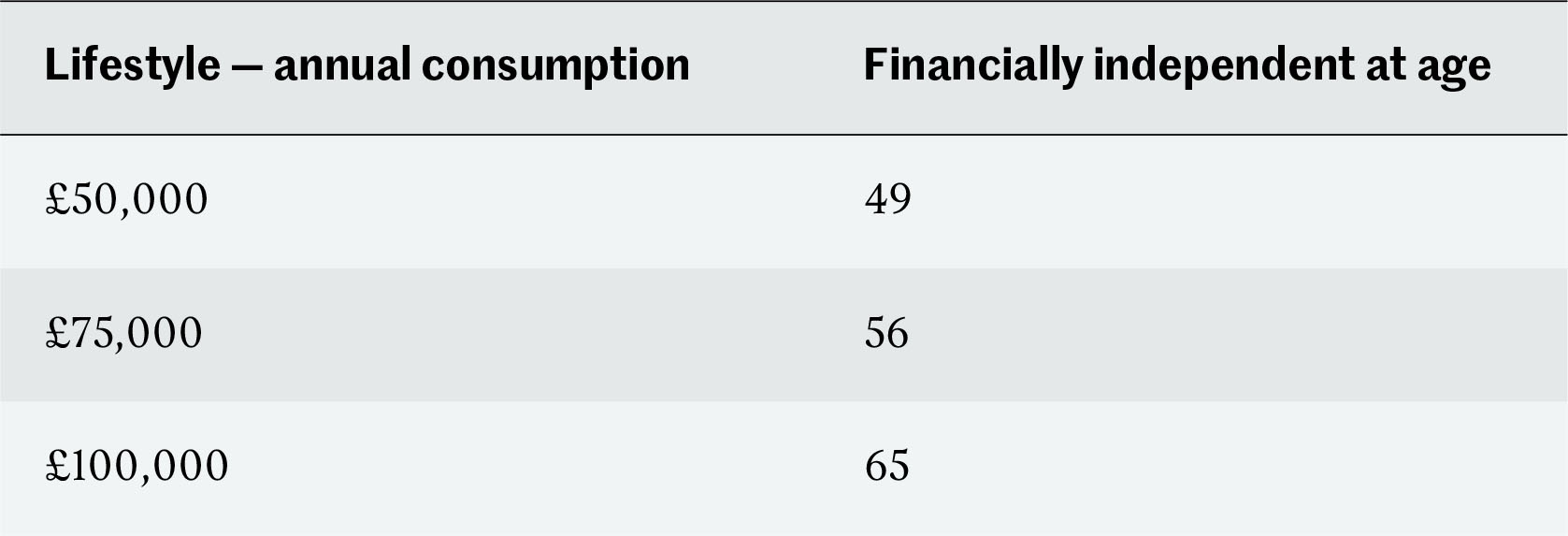

Why does this matter? The income you think you need determines how long it takes before you reach financial independence — the point at which work becomes an option. Let’s go back to our lawyer. Let’s assume for illustration that their pay increases in line with inflation for the rest of their career.

Making lots of sensible assumptions about investment returns, the size of their mortgage and so on, we can model how long they will have to work, depending on the lifestyle they need to support during their working life and in retirement.

A £50,000 lifestyle now and in future enables work to become optional at the age of 49 — a whole other career beckons. By contrast, a £100,000 lifestyle means clinging on until 65.

Each additional £ of spending both reduces what you can save today and increases what you need to save in order to fund expenditure in future. In this example, each additional £3000pa of spending adds a year to working life. Turning this around, if our lawyer saves just 1.5% more of their net income, they bring financial independence forward by a year. The difference between a £50,000 and £100,000 lifestyle is 16 years of work.

The exact numbers matter less than the principle. Sometimes successful professionals need a reality check. Relative to 90%+ of the population, £50,000 a year provides a very comfortable standard of living. £100,000 is top 1–2% for life. Target more than that if you want, by all means. But if that delays you from living the life you want to lead, it’s almost certainly not worth it.