MONEY

Understanding your relationship with money

Your relationship with money determines whether you can use your success to live the life you want to lead.

A lot of financial planning jumps straight from identification of a goal to designing a financial plan to meet that goal. But building a financial plan without first understanding the role of money plays in our life can be a big mistake. The most logical plans can be completely undermined by the behaviours caused by our relationship with money.

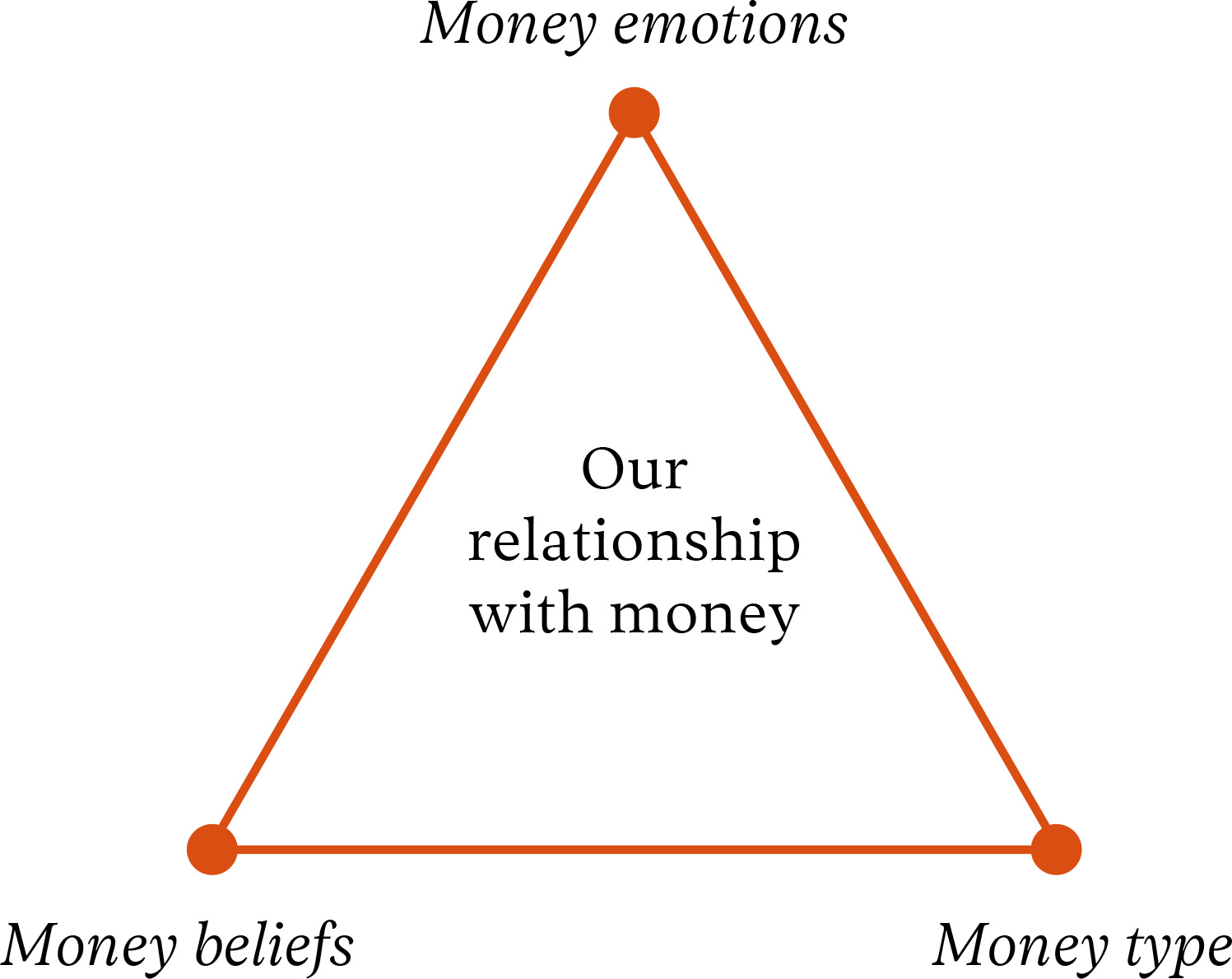

Money emotions, beliefs and types

We are ruled by our emotions more than we like to think, in matters of money as in other parts of our lives. Sometimes the connection between emotion and action is direct: feeling a lack of self-worth might cause us to spend, for example. But often the connection is more subtle. To maintain psychological balance we create stories for ourselves that rationalise our emotions. These stories are our money beliefs.

Money beliefs create patterns of behaviour that are consistent over time, and may even seem rational, but are often self-limiting. Someone who was starved of affection as a child may use pursuit of money as a proxy for love. They rationalise this pursuit of money through the belief that they need money for security. But it is somehow never enough (money can never replace love), they are never secure and they are always looking for more money and they are unable to enjoy it. The consistent set of (often self-defeating) behaviours that arise from our money beliefs can be called our money type.

Money beliefs can be dangerous because on the face of it they may be reasonable — in the example above, we do indeed need money for security. But when they are a cover for a deeper emotional need we can pursue them to an extent that is self-sabotaging.

So money emotions, money beliefs and money type are linked. Each connects to and reinforces the others in various and complex ways. Our view of who we are influences our behaviour and our behaviour reinforces our view of who we are. With healthy money beliefs this creates positive reinforcement. With unhealthy money beliefs it can be a vicious spiral.

When we were young

Our childhood experiences are crucial in defining our relationship with money. What did you learn about money when you grew up? Is money scarce or is it abundant? What emotions does money trigger: is it a source of pride, power, security, guilt or shame? Looking back at our early experiences of money and the example our parents set can help us understand our current money beliefs.

We all have our own unique relationship with money. In my own case, money has at times been a proxy for recognition, but also a source of safety: a protective barrier against criticism and a source of immunity from judgement. Money has also been tied up for me with complex questions of morality: materiality vs spirituality. These emotional dimensions of my relationship with money have had some benefits. I’ve tended not to become sucked into a high spending lifestyle, at least compared to peers. But these same factors have at times in the past made me enjoy spending money less than I might have. I’ve had to work on giving myself the permission to enjoy what I’ve earned. I’ve had to work on shifting my framing of these beliefs in order live with financial freedom.

Awareness is key

Meeting our financial objectives will require effective money behaviours. If those behaviours aren’t currently consistent with our money type then we’ve work to do. Hidden emotions are often at the root of money habits that can undermine our ability to meet long-term financial goals, whether it’s spending too much, an inability to save, putting off sorting out insurance or poor investment behaviour.

Understanding our money emotions and beliefs, and the cognitive distortions they create, gives us self-awareness which is the first step to change. If we can spot the emotional triggers of our self-defeating behaviour, we have an opportunity to challenge those emotions and can choose to act differently. If we can name our money beliefs then we can work on reframing them if they undermine us. In this way we can change, or at least adapt or manage, our money type.

Like any personal change, this isn’t easy. But understanding our relationship with money is a vital part of using our success to live the life we want to lead.